If you’re a tech person, who is also interested in financial independence, you know how important cashflow is. You also know to think in the long-term, and not in just the next 2 or 3 years.

If you’re trying to optimize for cashflow, one of the things you should do is look at your current costs, and your website is one of them.

For this article, I’m assuming your website is static, with no user accounts, etc. Just information and stories.

The Math

Let’s assume you pay 20€ per month for hosting a simple page and blog.

It might not seem like much, but if you’re looking for financial independence, let’s do some math.

Assumptions:

- Hosting costs 20€ per month.

- 4% yearly yield on your investments.

- 28% capital gains tax.

- You’re going to have a website for the next 15 years.

| Monthly Costs | Paid Hosting | Free Hosting |

|---|---|---|

| Monthly Costs | 20€ | 0€ |

| Required Time | Little | Little (using a template); A lot (custom) |

| 15-Year Costs | 3600€ | 0€ |

To pay for the website through your passive investments, you would need:

- Annual hosting cost: €20 × 12 = €240

- Effective yield (post-tax): ( 4% \times (1 - 0.28) = 2.88% )

- Required capital:

[ \text{Required Capital} = \frac{\text{Annual Cost}}{\text{Effective Yield}} = \frac{240}{0.0288} \approx 8,333 , \text{€} ]

So imagine that, you will need to save up €8,333 of your hard-earned money, invest it, pay taxes on it, and only then would you be able to pay for that website passively.

Opportunity Cost: What If You Invested Instead

Now, let’s assume instead that every month, you invest those same 20€ into an asset that pays you a 4% annual yield.

This is how much you would be earning without reinvesting the yield - just spending it at the end of every year and over the total 15 years:

| Year | Money Invested (€) | Monthly Yield (post-tax, €) | Annual Yield (post-tax, €) |

|---|---|---|---|

| 1 | 240.00 | 0.58 | 6.91 |

| 5 | 1,200.00 | 2.88 | 34.56 |

| 10 | 2,400.00 | 5.76 | 69.12 |

| 15 | 3,600.00 | 8.64 | 103.68 |

| Total (15 years) | 3,600.00 | 4.61 | 829.44 |

So the actual difference, even after a quite high, 28% tax, is:

[ \text{Savings + Yield} = 3,600 + 829.44 = 4,429.44 , \text{€} ]

By choosing free hosting and investing the hosting costs, you could save over 4,400€ after taxes in 15 years.

Weigh Your Options

Free Hosting

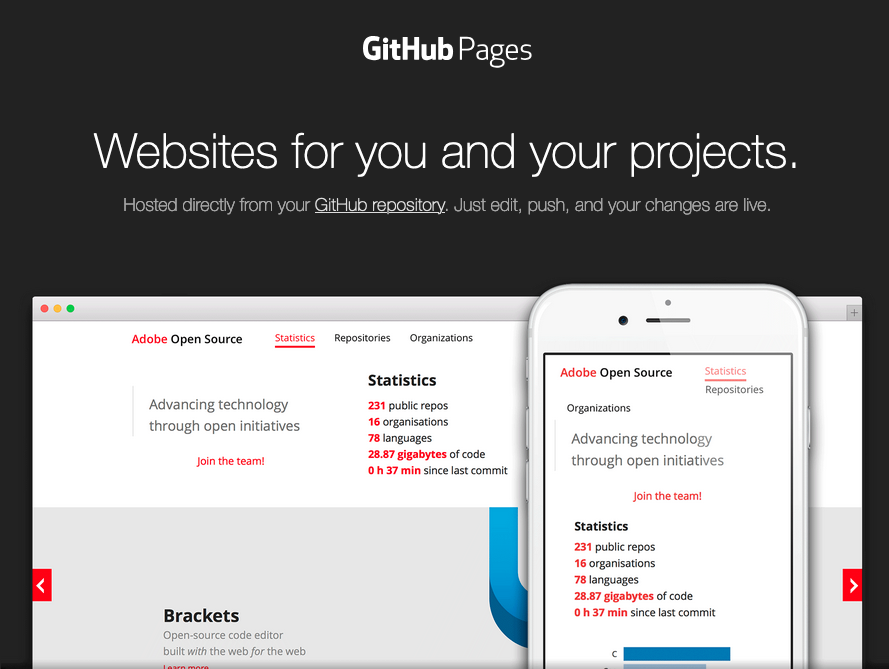

If you’re running a static website (simple page, no accounts, no complex features), free hosting options like GitHub Pages are worth considering. They’re fast, reliable, and require minimal setup. While there are other free hosting options, GitHub Pages stands out for simplicity and ease of use.

Paid Hosting

Paid hosting offers convenience, support, and flexibility but at a cost. If you’re regularly updating the website design, integrating advanced features, or relying on backend functionality, paid hosting might save time and hassle, making it worth the expense.

Final Thoughts

If long-term financial independence is your goal, free hosting can save you thousands while also building good financial habits and without losing much.

For a simple blog or portfolio, it’s a no-brainer. On the other hand, if you need a lot of customizations, paid hosting might be worth it, provided you’re not paying too much.

This applies to a simple expense of 20€ but consider the implications if this was 50€ or even 100€ a month. While it might not seem much today, it quickly adds up!

Want to Talk Strategy?

I’m a data strategist and AI consultant. If this article resonated with you, and you have a business where you’d like to apply similar strategies, reach out to me!